Enterprise Zone Program

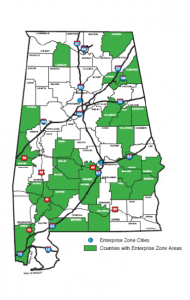

The Alabama Enterprise Zone Act was passed by the Alabama Legislature in 1987. The act authorized state tax and nontax incentives, which are some of the best in the country. Twenty-eight Enterprise

Zones across the State encourage economic growth in areas considered to have depressed economies. Each area offers innovative packages of local tax and nontax incentives to encourage businesses to locate or expand in its Enterprise Zones. Two Enterprise Zones are located in the SEARP&DC Economic Development District, Barbour County and Covington County.

State Tax Incentives

- Under Section 5 of the Act, an employer’s maximum tax credit for operations in the zone shall not exceed $2,500 per new permanent employee hired pursuant to the act. This tax credit may be applied in all Alabama Enterprise Zones to any Alabama Income Tax Liability or any Alabama Corporate Franchise Tax Liability.

- If an employer can certify that at least 30% of new permanent employees hired pursuant to the act were formerly unemployed for at least 90 days prior to this employment, then the employer qualifies for the following Alabama Income or Franchise Tax Credit on taxes due from zone operations:

- First year- 80%

- Second year-60%

- Third year- 40%

- Fourth year- 20%

- Fifth year- 20%

- Employers may receive the following Alabama Income or Franchise Tax Credit for new investments in the zone or improvements to existing facilities in the zone provided at least five new permanent employees are hired.

- 10% on first $10,000 invested

- 5% on next $90,000 invested

- 2% on remaining investment

- Employers may receive a maximum Alabama Income or Franchise Tax Credit of $1,000 per new permanent employee for expenses of training these employees in new job skills.

Under Section 11 of the Act

- Employers may receive an exemption from Alabama Sales and Use Tax on the purchases of materials used in the construction of a building or any addition or improvement thereon for housing any legitimate zone business and on machinery and equipment used in the zone.

- Employers may receive certain exemptions from Alabama Income and Corporate Franchise Taxes for a period of five years.

Requirements for Business Participation:

For Section 5 Incentives:

- Must be located in or locating within the boundaries of an Enterprise Zone.

- Must generally fall into Standard Industrial Classification (SIC) 20-42, 44-49 or consist of major warehousing, distribution centers, regional or corporate headquarters of companies in the referenced SIC codes or such other activities having a prospect of significant economic impact without threatening the well-being of existing industries located within the county hosting the Enterprise Zone.

- Must expand its labor force, make new capital investment or prevent loss of employment.

- May not have closed or reduced employment elsewhere in Alabama in order to expand into the Enterprise Zone.

- Must obtain an endorsement resolution approved by the appropriate local governing authority prior to participation in the program.

For Section 11 Exemptions: 1-5 above and:

- Must certify annually that at least 35% of its employees are residents of the hosting urban Enterprise Zone or are residents of the hosting rural Enterprise Zone county, and were receiving public assistance prior to employment, or were considered unemployable by traditional standards or lacking in basic skills, or any combination of the above.

- Must give preference and priority to Alabama manufacturers, suppliers, contractors, and labor, except where not reasonably possible to do so without added expense, substantial inconvenience or sacrifice in operational efficiency.

For more information about this program Contact:

Ms. Carmen Moa-Rivera

Enterprise Zone Coordinator

Alabama Department of Economic and Community Affairs

P.O. Box 5690 Montgomery, AL 36103-5690

(334) 353-5690